Jason Pront

Jason Pront's writing for Buzz Rant and Rave is primarily focused on business and the economy. He currently works as a professional options trader and is a member of the American Stock Exchange. He graduated from Cornell University in 2000, having studied Russian and East European Studies and Economics. Jason currently lives in New York City.

Recent posts by Jason:

November 30, 2004

Nature vs Nurture

Over at Marginal Revolution, (which is a great blog for the libertarian/lassez faire economic school,) there's discussion of a new paper which explores the effect of adoption on one's earnings potential. The results are certainly worthy of discussion:

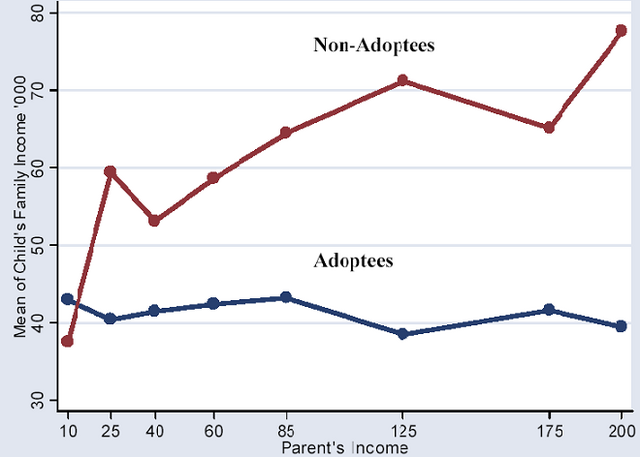

One could argue, as some do, that this graph is finally "proof" that nature triumphs over nuture - despite growing up in the same exact household, under the exact same conditions, adoptees just weren't affected by that environment to the same extent as their non-adopted siblings.

The unstated implication that many have taken from this chart is that the adopted sample earned less money than their non-adopted siblings. Let's be clear before we continue - this is not at all the case. All this chart shows is that there's no correlation between adoptees' incomes and that of their parents. They might all have been self-made millionaires, all paupers, but most likely, were just all over the map.

Now then, on to the study itself. The biggest flaw I see here is the fealty a biological parent shows towards a biological over an adopted child. By definition, this study compares adoptees to the biological children of their "parents." It's genetic - it's in our nature - to promote our own DNA, our progeny, at the expense of others. No matter how much a parent loves their adopted child, I'd suspect that more often than not it's the biological offspring who are groomed for the family business. Again, this isn't saying that the adopted children were cast aside - rather, they may well have been encouraged to go off to college and find a profession that would make them wildly more successful than their siblings. They could become doctors, lawyers, bankers, whatever. They're just plain not as likely to inherit the family store.

No single study is ever going to resolve the nature vs nurture debate. Primarily, this is because there is no answer. Concepts such as intelligence and earnings potential are affected by both nature and nurture. Are some people naturally "smarter" than others? You bet. Is "intelligence" dependent on whether you were encouraged and challenged as a child? Absolutely. Is one of these factors more influential on a specific person's ultimate intelligence? I'm sure of it. Is either nature or nurture more influential on a population's intelligence as a whole? Nope. Sorry. There are just too many variables to ever resolve this case on a universal level. Books like The Bell Curve which try to suggest an answer to the nature vs nurture question are filled with flawed studies and questionable data. We can just add this paper to the growing list.

Social science, an oxymoron if ever there was one, attempts to use scientific methodology to resolve questions which cannot be fit into a logical, black and white construct. Studies like this only exacerbate the problem - humanity and society are far too complex to be studied mathematically. It's impossible to control for every variable, so any study is, by definition, corrupted. The further we delve into the nature vs nurture debate, the more factors we discover that play a part in things like intelligence or earnings potential, two terms that are ill-defined at best. Ultimately, it's these variables themselves, not nature or nurture, that define our intelligence. Solving the nature vs nurture debate is as futile as it is difficult.

November 28, 2004

Diamond In The Rough

This is how the internet was supposed to work. Blue Nile, the world's largest online retailer of diamonds, has managed to significantly reduce profit margins in the retail diamond industry, creating a cheaper product for consumers while becoming very profitable at the same time. While I doubt diamonds are going to become commoditized any time soon, (for one thing, the second-hand diamond market is utterly dismal and probably manipulated,) this appears to be the first big step towards opening up a secretive and monopolistic industry.

November 16, 2004

Falling Dollar

There is no question right now that the US dollar is falling relative to foreign currencies. The important issue is what effect the falling dollar will have. The New York Times suggests three possible scenarios:

1. The US can continue to borrow indefinitely because today's financial markets have created a virtually unlimited source of capital.

2. The dollar will be propped up by Asian countries; a strong dollar benefits their labor and export markets

3. The dollar will collapse, leading to unemployment, inflation, and overall nastiness in the US economy.

I personally believe in choice 4: none of the above. My suspicion is that, as the dollar becomes weaker and weaker, the ability of Asian governments to maintain a high dollar will be tested. In particular, China, which currently pegs its yuan to the dollar, will find it untenable to maintain current exchange rates. While China would not want to harm its nascent economy by lowering the yuan peg, its ruling body would find the idea of black markets for currency or for valuable imported goods. I suspect China would be forced into devaluing the yuan, yet keeping it pegged to the dollar. This might cause some temporary choppiness in the global economy, but not the stagflation of the 1970's. Interest rates would probably rise a few percentage points, unemployment would creep higher, and imported goods would cost more. Still, there are too many interested parties concerned with keeping the US dollar relatively high. It would take a significantly larger shock to the global economy to cause significant stress on the dollar to create a tailspin scenario. The most likely stress of this magnitude would be if Asian borrowers decided not to repurchase US dollar denominated debt. This is not very likely - the US Treasury is universally considered the world's safest investment. Asian investors have stuck by while plummeting interest rates plus a falling dollar have shrank returns on US bonds to near nothing. Now that rates are rising again, pulling out of the US is far less likely.

November 3, 2004

Regrouping Around The Issues

Note: This was originally posted on DailyKos. Since it's relevant, important, and probably never got read on that site, I'm reposting it here verbatim.

After last night's defeat, one thing should be clear to all of us: we need to make some major changes. So far we've discussed who should lead the DNC and, who should be the new Senate Minority Leader, and we have rehashed last night until we are blue in the face.

What we need to talk about are the issues.

Our party is fragmented and disorganized. Our opponents have acheieved success because they have found a few key issues that they can rally around, while at the same time forcing us to either compromise or take a divisive stand. It's time for us to capture the issues of our own. I propose 2 major themes that we can use to shape the Democratic party of the future: Education and Environment

Education: This should be both a rally-point for us and a wedge issue for the Republicans. We need to make improving education in this country a main theme of all our future campaigns. Education helps future generations. It leads to job growth. It's an issue that's popular with young families, minorities, and women. Further, it challenges the Republicans to take an unpopular stand. Remember which party tried to eliminate the Dept of Education, and remember the effects. We should have gone for the jugular on education then, but it's not too late to go for it now. Any Republican who opposes education reform is against children. Pure and simple meme. It's our issue, and we need to frame it as such.

Environment: This is also a big one for us. It's traditional Democratic territory that should be a huge home if we'd only capitalize on it properly. The framing of this issue is equally simple - Republicans who oppose environmental reforms are favoring Big Corporations while you get sick. Environmentalism is an issue that our entire base can rally around. It can also gain us some votes from ranchers in the midwest, from hunting advocates, from farmers, and from swing states like Colorado, Arizona, and New Mexico, which have big tourism industries that center around National Parks.

People, it's time to get active. Yesterday has only proved that we can't win by playing defense and confronting Republicans on issues that they've framed as their own. Rather we need to go on the offensive, and take control of the debate.

October 24, 2004

Borrowing Against The Future

After nearly 25 years of theorizing and debate, a new pilot program is about to begin in Connecticut allowing individuals to borrow against their 401k plans via a credit card. The idea is not without controversy - proponents, like Nobel Prize laureate Franco Modigliani, believe this plan will encourage workers to contribute more to their 401k plans. Opponents, including Senator Chuck Schumer (D-NY), fear the plan will reduce the savings rate even further. As with any economic discussion, both sides seem to have merit.

Opponents of the plan worry that making it easy for individuals to borrow against retirement plans could lead to a rash of foolish spending. People who suddenly find themselves with a new source of easy money that they can borrow against are likely to spend that money. While, technically, that money needs to be paid back, under this plan after a few months any outstanding loans are converted into early withdrawals, which are taxed at the standard rate for pre-retirement deductions. I agree that this is problematic - currently to withdraw money from a 401k, one must contact one's plan administrator, who is likely to alert his customers to the penalties and taxes involved. However, when a consumer sees just how easy it is to borrow against that 401k, especially when they're given a VISA card that only charges 2.9% above prime, how likely are they to read the fine print? Given the extremely high rate of credit card debt in the US right now, do we really want to enable additional borrowing where the consequences of default include both a significant reduction of savings levels plus major tax penalties?

I have one other concern about this plan that I haven't seen addressed yet. As the plan is written, borrowers may spend no more than 40% of the total asset value of their 401k via this new VISA card. Obviously there is a necessity for a spending cap, since the idea is to try and prevent people from spending too much of their retirement money. However, what happens in a case like Enron, where the value of employees' retirement plans plunged to zero in a matter of weeks? People who have borrowed against their 401k have suddenly seen the collateral for their loans disappear. Not only did they just lose their entire retirement, but now they also owe a significant amount of money to their credit card, which most likely will no longer be constrained by the low interest rates built into the current program. As the loan is no longer collateralized, the banks will probably be able to raise interest rates on these loans to market rates - in some cases over 20%. Further, the IRS will, presumably, still be able to charge penalties for early withdrawal, even though the 401k is now worthless!

Proponents of the plan argue that, if people are allowed to borrow against their 401k, they're more likely to contribute to the plans. While I agree that people should be encouraged to save for retirement as much as possible, I'm wary of any method that involves borrowing against savings. The idea behind retirement savings accounts, and all the tax benefits that come with them, is that they are supposed to be untouchable savings. There are penalties against early withdrawal because this money is supposed to grow, untouched, until retirement, when it may be the only viable source of income for most people.

Allowing loans against 401k plans that can so easily become permanent withdrawals flies in the face of the underlying concept of the retirement account. The upcoming pilot program for this plan will show whether people actually use this plan properly or, as I suspect, drain their retirement accounts without considering the consequences. I hope I'm wrong.

October 13, 2004

Why The AMEX Is A Dysfunctional Exchange

Today there was a big controversy on the floor regarding a certain trade. I know few of you are excited about the specific details, but bear with me here. I'll try and be as succinct as possible.

A broker, let's call him John, traded 5000 options as a cross, meaning he represented both the buyer and the seller on the trade. Fine, no problem. A second broker, let's call her Jane, is alerted by her firm that this trade took place. Their client is interested in doing the trade, so Jane asks Joe if there's any more available. John says yes, that one of his clients will give up 2000 of the 5000 to Jane's client. Also OK so far. John and Jane both report to their clients that the trade is done. Then John tells Jane to go do the other half of the trade. What other half? Jane was not aware that there was another side to the trade. Problem. Jane's customer is not interested in that other half of the trade. Bigger problem. John's customer, however, is not willing to take back the trade he just gave up. Really big problem. John and Jane now have a $5,000 error. Here's where it gets sticky: Jane claims she's not liable. Since the trade was done outside of the trading crowd, it never "really" happened. This is tecnhically correct, since no trade is legally permitted to occur outside the crowd. But Jane, if it's illegal to trade outside the crowd, what exactly were you and Joe just doing over there in the corner? It sure sounds like a trade to me. Jane, are you telling me that you're admitting to doing something illegal in order to weasel out of your half of a $5,000 error? Does that mean that if I steal a car and drive into someone's pool I shouldn't have to pay the damages because techncially I should never have been driving that car in the first place?

Now, this whole situation was ruled on, and appealed, and appealed again, and then again, and is now being sent to arbitration. What I want to know is why haven't Joe and Jane been disciplined for trading outside the crowd? This happens to be a really big deal. Trades must be consummated within the trading crowd because, if they weren't, customers would have no way of knowing if they got a fair price. Since the brokerage firm is also representing themselves in this case, it's in the firm's best interest to give the customer as bad a price as possible, since those losses are realized as profits by the trader on the other side. It's the same reason why stock must always be traded on the stock exchange and nowhere else - transparency of markets allows for fair trading.

What got me livid, though, is the fact that nobody on the AMEX seemed to be upset about this. None of the other traders or specialists realized the precedent this sets. If you allow trades to go up between brokers outside the crowd, then you might as well just let the broker booths phone each other. And if you're letting the booths phone each other, you may as well have the firms contact each other directly, without even bothering with brokers at all. At that point there is exactly zero transparency of markets. Customers have absolutely no recourse against their brokers taking complete advantage of them. Something like this would never be allowed to take place on the CBOE. But since the AMEX is controlled by brokers, no trader or specialist is willing to take a stand against abuse like this. Frankly, if this is how the AMEX is going to treat blatantly illegal action, we might as well close the exchange now.

October 2, 2004

Inflation Con Job

For the past 6 months or so I've been wondering about the incredibly low inflation numbers being released by the Fed. With prices of oil, steel, and other commodities rising so high, surely the prices of durable and consumer goods would have to be going up. Even excluding food and energy, (a dubious consideration which I'll leave for another post,) a trickle-down effect from raw materials to the price of completed goods is inevitable.

Some time ago I suspected that the cause of such a low number was some sort of stealth deflation. Turns out that I was wrong. It seems that rather than prices in some sectors falling significantly to offset other prices rising, it seems the government is intentionally skewing the numbers to make it appear that prices are not rising as fast as they really are. According to PIMCO Managing Director Bill Grossman, the government has been taking advantage of something called hedonic adjustment to artificially state a lower rate of inflation than is actually observed.

A distortion like this would have huge ripple effects on the national and global economies. Primarily, higher inflation would significantly dis-incentivize the holding of US Treasury bonds. If inflation is really closer to 3.7%, that would mean that the holder of a 10-year bond would only be getting a return of 0.5% after inflation. Holders of shorter-term treasuries would find themselves actually saving at a negative rate! Naturally, few rational investors would want to hold bonds for such a paltry return, and would be likely to sell. As mentioned before, the largest holders of US Treasuries are foriegn investors; if they sell their bonds, and then repurchase their own currency with the proceeds, they push down the value of the US dollar. This, in turn, causes prices to rise further, and perpetuates an inflationary cycle.

If this article has any truth to it, and I suspect it may based on my own observations and intuition, we could see a big shakeup in the bond market in the coming months.

September 29, 2004

The Science of Economics

University of Texas Law Professor Brian Leiter writes an extensive essay on the faliure of economics as a predictive science. While I certainly agree that economics is far, far from perfect, I disagree that it is an overall failure. Economics as a science is still in its early stages. Complex methodology designed to predict outcomes of many participants, like game theory, are only a few decades old. We're only beginning to develop the necessary tools for observation as well; economics is somewhat like quantum physics - it's nearly impossible to observe economic phenomena without affecting their ourcomes.

Perhaps the most interesting new method of economic observation and modelling has come from the creation of online virtual worlds. Massively multiplayer games are complex enough to allow for realistic modelling, yet still controlled enough to create concrete, verifiable theories. While research in this field is still in its infancy, some excellent papers have been written on the subject.

The next phase in virtual world economics is the shift from observation to creation. Thus far, all of the work done on virtual worlds has been from the perspective of a participant-observer. This observer has access to much of the information available in the given world's economy, but has no control over the global variables involved. The next logical step is for economists to create their own virtual world, with their own rules and restrictions, that allow for experiments to be created and theories to be tested. It is this type of environment, with many participants trying to maximize their virtual wealth under a specific set of rules, that will create the next big breakthrough in economics.

September 28, 2004

Bush's Retirement Plans

There have been many criticisms of Bush's proposed private retirement accounts. Many critics have focused on the American public's generally poor history with 401k plans and other owner-directed savings vehicles. While I agree that, generally, the public in general invests poorly, I think there's a broader concern about this plan that hasn't really been discussed.

Many advocates of the President's plan jubilantly tout the concept of increased returns for the investor. By investing in the stock market, the supporters claim, plan participants will see much higher returns than had they stayed with a traditional Social Security plan. Historically the stock market has averaged around 10% annualized returns - far better than fixed income portfolios. In fact, if you invested just $5,000 at that rate for 40 years, you'd retire with over $225,000.

All these numbers are, technically, correct. However, any statistician can tell you that just because an investment averages 10% over time doesn't mean it always returns 10%. In fact, the stock market's returns have shown many peaks and valleys over the years. The 1990's saw phenomenal market returns, but these were preceded by the very poor performance of the 1970's. And, as most investors can tell you, the past 5 years can hardly be classified as positive.

These peaks and valleys can wreak havoc on personal investors. Consider that same investor, who puts $5,000 into the market, but this time he invested in late 1999. After riding out the roller coaster of the past 5 years, that investor would now have right about what he started with 5 years ago. Even if he manages 10% every year after 2004, he'll only get about $140,000 at retirement. That's a loss of $85,000, or 37%.

There's something to be said for constant, predictable returns. Compounding interest only works if the compounding is done consistently. A poorly-timed downturn can devastate a portfolio. And, unlike statisticians, you can't tell a retiree not to worry because they'll get 10% over the long run. These people don't have the ability to wait a few decades for the law of averages to kick in.

There is something to be said for predictable returns - slow and steady wins the race.

September 24, 2004

Rates Rising?

There seems to be an interesting battle developing between the Federal Reserve and the bond market. The Fed just raised short term rates to 1.75% after determining that the economy is beginning to recover. Bond yields, however, are falling to new lows on a lack of inflation fears. So what does this flattening of the yield curve mean for the US economy? Possibly trouble. By flattening the curve, the markets are making long-term investment in US treasuries less attractive. Why get 4% over 10 years when you can get almost 2% over 3 months? This is a big problem for the US, since much of what's preventing the dollar from sliding is the heavy buying of US bonds by overseas investors, primarily the Chinese. As long term interest rates decline, foreign buyers will become increasingly dissatisfied with low returns, and increasingly wary of potential losses they would take if the dollar did significantly decline. Thus, demand for long term bonds decreases, forcing the Treasury department to sell more cheap bonds, which causes them to fall in value, which causes interest rates to rise, which causes inflation, which causes the dollar to drop, which forces down demand for US treasury bonds...

Certainly it's not yet time to panic. As long as demand for bonds at the weekly Treasury actions remains strong, the dollar should stay stable. However, the flattening of the yield curve would certainly make some investors think twice about the benefits of investing in US bonds long-term.

August 15, 2004

Oil Keeps On Rising

Between Yukos, Iraq, Venezuela, and the general fear of terrorism that is pervading the markets, oil has once again hit a new record high. Anyone interested in the subject should check out this excellent discussion of the current situation over at Daily Kos.

August 10, 2004

Yukos

There's been a lot of talk recently about how Russia's Yukos situation has been driving up the price of oil, and thus weighing on the stock market. I'll try to make some sense of it all here.

Basically, it's a combination of politics and confusion. Yukos is one of Russia's largest oil companies, responsible for about 20% of the country's daily output of crude oil. As Russia is a very large producer of oil worldwide, any problems at a firm like Yukos would clearly have an impact on the worldwide oil markets.

And problems are certainly what Yukos is dealing with right now. Mikhail Khodorovsky, Yukos' largest shareholder, has found himself in the crosshairs of Russian President Vladimir Putin, after Khodorovsky attempted to use his fortune to finance Putin's opponents during the last election. In response, Putin's government has accused Yukos of failing to pay over $3.4 billion, and has frozen the assets of the oil giant.

By freezing Yukos' accounts, the government has rendered the oil producer impotent. Unable to finance its operations or pay its bills, Yukos is rapidly approaching the point of being unable to continue production or shipping. At this point, worldwide oil production will drop by as much as 2%, as Yukos is taken completely off-line, causing a spike in oil prices.

Crude oil prices are already responding to the threat of a Yukos shutdown, hitting record highs just below $45 per barrel. Adding to the fears is the utter confusion regarding the status of Yukos and the courts. Last week, Russian officials siezed control of Yukos' largest subsidiary. The following day, the courts ruled the government's siezure illegal. Today, however, Russian officials again siezed control of Yuganskneftegaz, the subsidiary of Yukos responsible for over 60% of the firm's oil production.

Worrisome to many is the precedent that Putin's actions will set. Few believe that Putin legitimately is concerned about lost tax revenue. There is strong circumstancial evidence that Putin is attempting to punish his opponents and strengthen his allies among Russia's super-rich, especially given his unwillingness to settle the claims against Yukos, or even negotiate with the firm. Many fear the firm will be re-nationalized or dismantled, with the valuable assets resold to other oil firms such as Lukoil at very generous prices.

If there are two things that the stock market hates, they are uncertainty and high oil prices. The Yukos situation involves a lot of both. Until Yukos is either dismantled or pays off the debts the government claims it owes, expect markets worldwide to remain jittery.

June 12, 2004

Oil Production

The New York Times has an article which shows an interesting divergence between oil production and oil reserves at the major petroleum firms worldwide. Apparently, even though reserves have remained stable or even increased, production levels have begun to fall. The article suggest, though not in so many words, that reserve numbers are manipulatable, but production is much easier to verify. Perhaps the peak oil theorists are on to something after all.

June 2, 2004

Rating Agencies in the EU

Over at Truck & Barter there's an interesting analysis of an article about some German banks balking at the idea of the big 3 US rating agencies - Standard & Poors, Moodys, and Fitch - essentially having a monopoly on determining the creditworthiness of European banks. T&B thinks that the Germans are making a mountain out of a molehill, and more concerned with national pride than the consequences of an unsound rating system. While I agree that nationalism seems to be trumping fiscal common sense in this case, the underlying issue remains: we need more independent firms to analyze creditworthiness of corporations and institutions. The current oligopoly is too easily manipulated, as the drive for profits can convince the big 3 to be generous with their ratings. The more firms that perform audits, the harder it will be for a nefarious company to bribe its way out of a poor credit rating. Further, the more sets of eyes that go over a balance sheet, the more likely trouble is to be spotted before the firm defaults. Remember, Enron was still rated "investment grade" by S&P and Moodys just 4 days before it officially declared bankruptcy.

May 16, 2004

$41.56

That's the price of a barrel of crude oil as of Friday's market close - the highest level since 1983. And it's not likely to go lower. As the New York Times points out, Saudi Arabia has too many reasons to keep the price of oil high. The country's economy has been booming, and many new public works are to be funded with oil revenue. Further, the Saudi government is afraid of appearing too friendly towards the US, and many European and Asian companies are now making major inroads in the Saudi business world.

Recent reports claim that Saudi Oil Minister Ali Naim is calling for an increase in OPEC production. Curious, since it was just March when Naim forced a cut in oil production. Nonetheless, current estimates are that the OPEC member nations are already exceeding their stated quota by as much as 2 million barrels per day. An increase in the production ceiling may only legitimize this overproduction, but wouldn't do much for increasing actual supply. Most oil producing nations are already producing at capacity, and it will take months if not years to bring new supplies to market.

Current estimates are that there is currently a risk premium of $4-$8 per barrel on the price of crude. My belief is if a major event were to occur in the Middle East, one that would significantly disrupt oil production even for a short period of time, we could see $60 per barrel or higher. Historically, spikes in oil prices have been followed by economic recession in the US. The US economy, barely recovering from the dot-com bubble's burst, is in no shape to handle $40 oil, let alone any further spikes.